Portuguese Finance Minister Mario Centeno said debt is declining and funding for this year is “under control” as European officials urged reforms following an increase in the country’s borrowing costs.

Portuguese Finance Minister Mario Centeno said debt is declining and funding for this year is “under control” as European officials urged reforms following an increase in the country’s borrowing costs.

“We have a cash buffer that is large enough to face the year in a comfortable position,” Centeno said in a Bloomberg Television interview on Thursday in Brussels. The minister said he doesn’t expect Portugal will have to rely on that cash buffer instead of market financing. “We have a year that is pretty much under control in terms of funding.”

Portugal’s net financing needs in 2017 will be about 12.4 billion euros ($13.3 billion), debt agency IGCP said on Jan. 10. It sold 3 billion euros of 10-year debt via banks on the following day. The treasury cash position was 10.2 billion euros at the end of 2016. Centeno said there will also be “windfalls” from the repayment of Banco Comercial Portugues SA’s contingent convertible bonds.

Markets are “nervous” about Portugal’s debt level, financial sector and competitiveness, European Stability Mechanism Managing Director Klaus Regling told reporters in Brussels on Thursday. “But I’m confident that if they address these issues, markets will react positively.”

Portuguese Prime Minister Antonio Costa was sworn in at the end of 2015 and his minority Socialist government is reversing state salary cuts faster than the previous administration proposed, while increasing indirect taxes. While Portugal exited its three-year international bailout program in 2014, it’s still dealing with pending issues including bad loans at banks.

“We take stock of the fact that there is some volatility and it underlines again the need for Portugal to push forward the reform agenda to which they have said they are committed and to take further steps in strengthening the banks, which is being worked on,” Dutch Finance Minister and Eurogroup chair Jeroen Dijsselbloem told reporters on Thursday. “I think they are taking the right actions.”

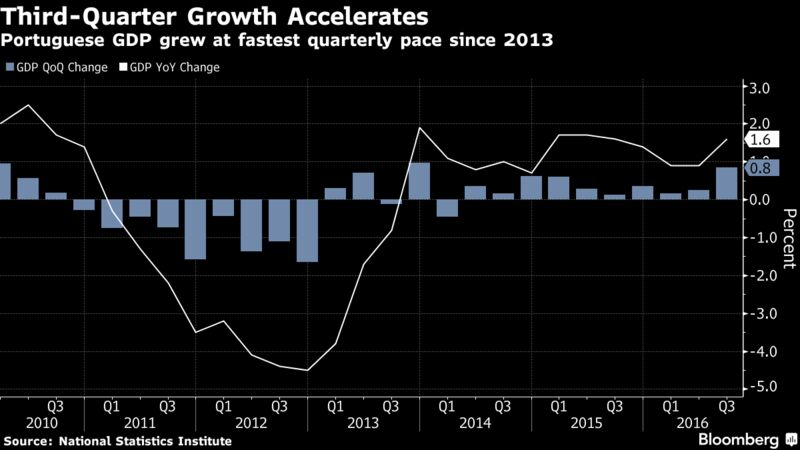

Debt as a percentage of gross domestic product is declining and fiscal consolidation is on track, Centeno said in the interview after a meeting of euro region finance ministers. “We were the fastest-growing economy in the euro area in the third quarter of 2016,” he said.

Portugal forecasts economic growth will accelerate to 1.5 percent this year and sees debt falling to 128.3 percent of GDP in 2017.

“Borrowing costs of course are a matter of concern,” Centeno said. “There’s a little bit of volatility. We do have some political uncertainty in the world. We expect this volatility to fade away.”

Caroline Connan, Bloomberg

Comments

At present, we see an "improved" situation; with Novo Banco and Caixa Geral on the back burner until next year. Either the present government is living on the credit of the PSD and its actions; or the socialists are showing the world how to defeat austerity. Neither explanation is credible.

What we read in the press is all made up, and designed to keep the masses reading their newspapers, while the bankers fudge the figures.

Your spending year in and year out continues to out grow your incoming funds. So you borrow to plug the present gaps and possible future funding gaps. Then you try to tell everyone all is fine. Seems to me you are not fit to hold your position,,