Banco Popular remains open for business in Spain and Portugal after 100% of Banco Popular’s shares were bought yesterday by Santander for a symbolic €1.

Banco Popular remains open for business in Spain and Portugal after 100% of Banco Popular’s shares were bought yesterday by Santander for a symbolic €1.

The transfer has been pitched as ‘part of a resolution measure’ after the European Central Bank determined that the financial institution was not viable, giving it a damning "failing or likely to fail" vedict.

Banco Popular will operate under normal business conditions 'as a solvent and liquid member of the Santander Group with immediate effect'.

At the end of 2015, Santander Totta acquired Banif which also had run into irredeemable financial trouble. Banif cost taxpayers and shareholders dearly but Santander won’t need State funds in the Popular purchase.

Banif involved public of €2.25 billion to cover future contingencies, of which €489 million came from the Resolution Fund and €1.76 billion from taxpayers. It appears that the Banco Popular purchase will not be a drain on public funds, mainly because the Bank of Portugal is not involved.

"The decision taken today safeguards the depositors and critical functions of the Banco Popular. This shows that the instruments given to supervisory authorities after the crisis are effective to avoid the use of taxpayers' money in bank redemption," says Elke König, president Of the Single Resolution Council which thankfully has taken over banking resolutions from the Bank of Portugal’s inept and fumbling governor.

The deal inflicts losses of €3.3 billion on bond holders and shareholders but avoids a taxpayer bailout and demonstrates the usefullness of the Single Resolution Board, the Brussels body established to deal with bank collapses in a a way that shields taxpayers.

The purchase includes the Popular branches in Portugal run by a subsidiary of the Spanish lender.

“Banco Popular Portugal, was in the process of being transferred from a national bank to a branch of Banco Popular but now is a part of Santander,” clarified the Bank of Portugal in a statement issued on Wednesday morning.

"The Portuguese branch of Banco Popular Español - Banco Popular Portugal, SA - has not been subject to any resolution and is included in the sale,” according to Bank of Portugal which added that "This measure does not imply any change in the activity of the Portuguese bank, which continues to operate normally and now is integrated into a new banking group."

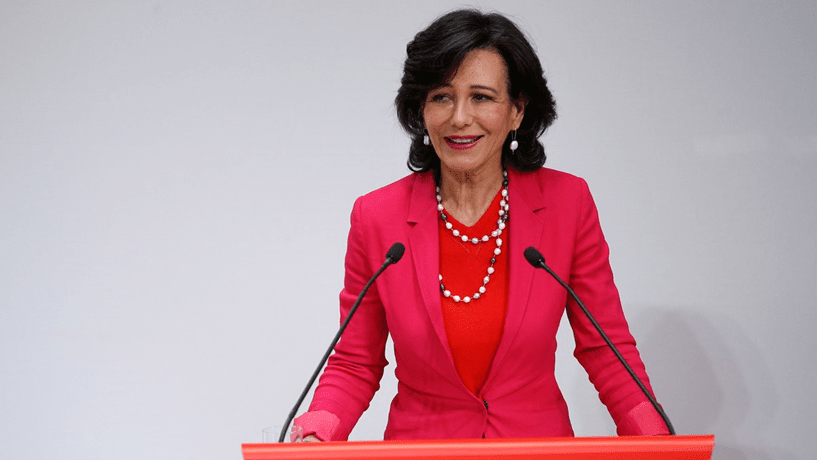

Santander's board of directors, headed by Ana Botín, (pictured below) will have to authorise a capital increase of €7 billion "which will guarantee the capital and the necessary provisions so that Banco Popular can operate normally."

"The significant deterioration of the bank's liquidity situation in recent days has led to the determination that the entity would in the near future be unable to pay its debts and other liabilities," according to the European Commission which approved the deal as no State aid was involved.

Banco Popular's capital was mostly held by institutional investors - with 47.21% of the bank - followed by small investors (28.71%) and the board of directors, with 24.08%, according to Information on the bank's website. Santander intends to offload at least 50%of Banco Popular’s property portfolio within 18 months.

The value of Popular’s shares had been worsening in recent days due to concerns about the institution's ability to continue.

The Bank of Portugal’s statement reads as follows:

The Sole Resolution Council, acting as the competent resolution authority within the framework of the Banking Union, today decided to proceed with the sale of Banco Popular Español, S.A. to Banco Santander, S.A., in the context of a resolution concerning the Spanish bank.

The resolution measure determined by the European Resolution Authority has benefited from cooperation with the competent supervisory authority, which is the European Central Bank - the Single Supervisory Mechanism.

The Portuguese branch of Banco Popular Español - Banco Popular Portugal, S.A. - has not been the subject of any resolution and is included in the sale and is now part of the Banco Santander group.

For Banco Popular Portugal, this measure does not imply any change in the activity of the Portuguese bank, which continues to operate with total normality, now integrated into a new banking group.

This solution does not include financing by national bodies and protects the savings entrusted to Banco Popular Portugal, ensuring the continuity of services provided in Portugal and financing to the economy.

The solution therefore preserves the stability of Banco Popular Portugal and contributes to safeguarding the stability of the Portuguese financial system.